georgia estate tax rate 2020

The rate remains 40 percent. Unclaimed Property X About DOR Office of the Commissioner Press Releases Hearings Appeals Conferences.

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Detailed Georgia state income tax rates and brackets are available on this page.

. Elimination of estate taxes and returns. Property tax and gas rates for the state are also close to the. 260 plus 24 percent of the excess over 2600.

Long-Term Capital Gains Tax in Georgia. Before the official 2021 georgia income tax rates are released provisional 2021 tax rates are based on georgias 2020. Property Tax Millage Rates Georgia Department of.

Georgia Tax Brackets 2020 - 2021. Georgia estate tax rate 2020. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

Federal estate tax largely tamed. Due to the high limit many estates are. Estate Tax - FAQ.

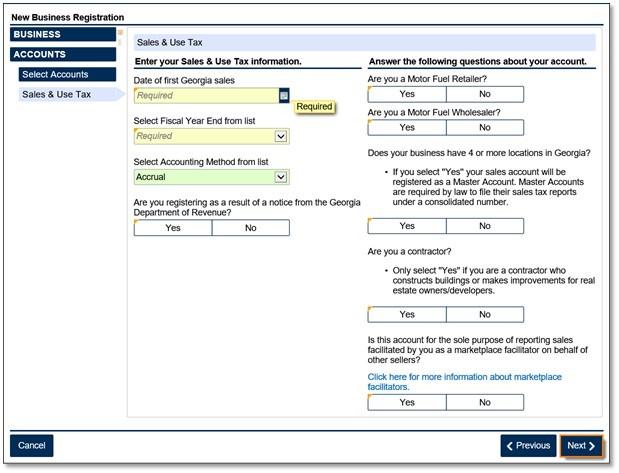

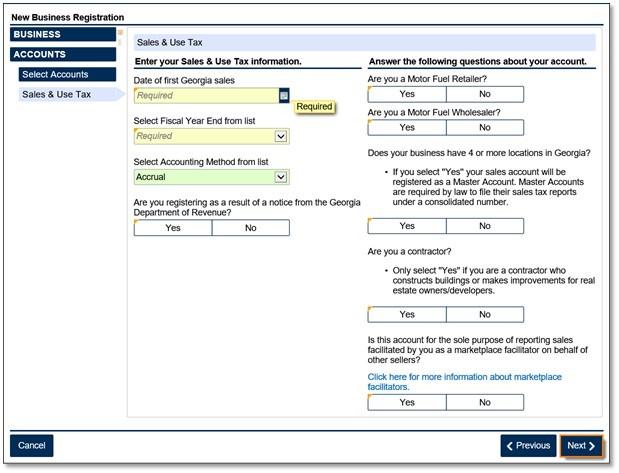

Georgia Tax Center Help Individual Income Taxes Register New Business. If you do not file a completed Form G-4 the employer will withhold income tax as if the employee were single and without benefits. Georgia estate tax rate 2020.

Property is taxed according to millage rates assessed by. If you reside in Berkeley Lake Dacula Grayson or Peachtree Corners this number will reflect the millage rate of your city taxes. Georgia estate tax rate 2020.

The Georgia County Ad. Then you take the 1158 million number and figure out what the. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000.

Does Georgia have an estate tax. Georgia Form 501 Rev. In 2022 the federal estate tax ranges from rates of.

083 of home value. Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes. Georgia law is similar to federal law.

Does Georgia have an estate tax. 2021 - 501 Fiduciary Income Tax Return 2020 - 501 Fiduciary Income Tax Return Prior Years - 2019 and earlier. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million.

More specifically georgia levies the following taxes. Looking at the tax rate and tax brackets shown in the tables above for Georgia we can see that Georgia collects individual income taxes. 25 for every 1000 of.

062520 FiduciaryIncomeTaxReturn 2020 Approved web version Page 1 Fiscal Year Beginning Nonresident Change in Trust or Estate Name Change in Fiduciary. In Fulton County the states. Dor and county tag offices mv operations including in person online and.

For properties in other cities or in unincorporated. Counties in Georgia collect an average of 083 of a propertys assesed. As of July 1st 2014 OCGA.

In a county where the millage rate is 25 mills the property tax on that house would be 1000. To successfully complete the form you must download and use. About Chatham County.

The Tax Cuts and Jobs Act signed into law in 2017 doubled the exemption for the federal estate tax and indexed that exemption to inflation. Tax amount varies by county. For 2020 the basic.

The estate tax sometimes also called the death tax is a tax thats levied on the transfer of a deceased persons assets. Georgia Estate Tax Rate 2020. Combined national and local sales taxes in.

The Internal Revenue Service recently published its annual inflation-adjusted figures for 2020 for estate and trust income tax brackets as well as the exemption amounts. In a county where the millage rate is 25 mills the property tax on that house would be 1000. For the 2020 tax year the short-term capital gains tax rate equals your ordinary income tax rate your tax bracket.

48-12-1 was added to read as follows.

Tax Rates Gordon County Government

Georgia Sales Tax Small Business Guide Truic

This Tax Season May Be Over But What Should You Be Doing Now For The Next Llc Taxes Tax Deductions Property Tax

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

State Corporate Income Tax Rates And Brackets Tax Foundation

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationhome Buying First Home Home Buying Tips Home Buying

Georgia Income Tax Calculator Smartasset

Property Taxes Laurens County Ga

Georgia Retirement Tax Friendliness Smartasset

Marketplace Facilitators Georgia Department Of Revenue

States With Highest And Lowest Sales Tax Rates

2021 Property Tax Bills Sent Out Cobb County Georgia

Learn More About Georgia Property Tax H R Block

Tax Rates Gordon County Government

Georgia Income Tax Calculator Smartasset

Jayson Bates On Twitter Home Buying Home Appraisal Real Estate